Super.com increases advance amounts through Pave’s custom Cash Advance Score

Learn how Super.com increased cash advance amounts while reducing default rates using a custom Cash Advance Score from Pave.

Goal

Grow advance amounts for users while maintaining repayment rates.

Problem

Super.com sought a cashflow analytics partner to safely raise cash advance limits by accurately identifying users with genuine repayment capacity while minimizing risk.

Solution

By customizing Pave’s Cash Advance Score, Super.com identified a meaningful share of users who could safely receive higher advance amounts while maintaining repayment performance.

Challenge

Super.com wanted to responsibly increase cash advance amounts for loyal, repeat users and improve how they identified users who could safely afford higher advance amounts. To enable this growth without introducing additional risk, they needed a cashflow analytics product capable of:

- supporting their best-in-class decisioning and delivering meaningful lift in segmenting high-performing, repayment-reliable users;

- distinguishing true repayment capacity from temporary balance spikes.

Their previous vendor struggled with uptime and reliability, creating decisioning delays, customer frustration, and measurable revenue loss. Super.com needed a partner whose infrastructure and modeling pipeline could support continuous, zero-disruption underwriting.

Solution

Super.com and Pave collaborated to develop a custom Cash Advance Score, tuned specifically to Super.com’s user population and lending objectives. The model combined:

- Pave’s repayment-driven Cash Advance Score and cross-provider repayment history

- Super.com’s own signal data, including user tenure and marketing channel performance

The resulting model more accurately predicted repayment capacity by analyzing how tenure, income stability, and spending patterns interact. Controlled A/B testing then increased advance amounts for qualified users, with repayment performance tracked throughout the experiment. And because Pave’s infrastructure consistently delivers 99.9%+ uptime, Super.com could deploy, test, and scale the new score without fear of outages interrupting underwriting decisions or limiting growth.

Approach

- Data Integration and Enrichment

Pave analyzed repayment and advance history across thousands of users, integrating Super.com’s internal attributes (such as tenure and acquisition channel) into its existing repayment model. - Model Development

The new custom Cash Advance Score balanced repayment rate, income stability, and spending patterns to segment users into risk bands with clear thresholds for safe limit increases. - Testing and Validation

The teams jointly backtested the model using Super.com’s underwriting and repayment data. The experiment measured both D14 repayment rate (14 days post due date) and average advance size across treatment and control groups.

Results

- Approximately half of advances in the ‘Excellent’ score segment qualified for a safe increase in advance amount.

- Within this cohort, default rates decreased 20%, demonstrating improved repayment prediction.

- The model enabled responsible growth, allowing more users to access higher limits without elevating risk.

Together, these results showed that customizing Pave’s Cash Advance Score to Super.com’s unique borrower base significantly enhanced predictive accuracy and portfolio performance.

Conclusion

By tailoring Pave’s Cash Advance Score to their own repayment data and user insights, Super.com established a smarter, data-driven framework for advancing loyal customers. The collaboration validated that small, product-specific adjustments can meaningfully expand access while maintaining repayment performance.

Custom versions of Pave’s Cash Advance Score allow lenders to align underwriting more closely with their borrower base, turning internal signals into measurable, lower-risk growth opportunities.

Explore Use Cases

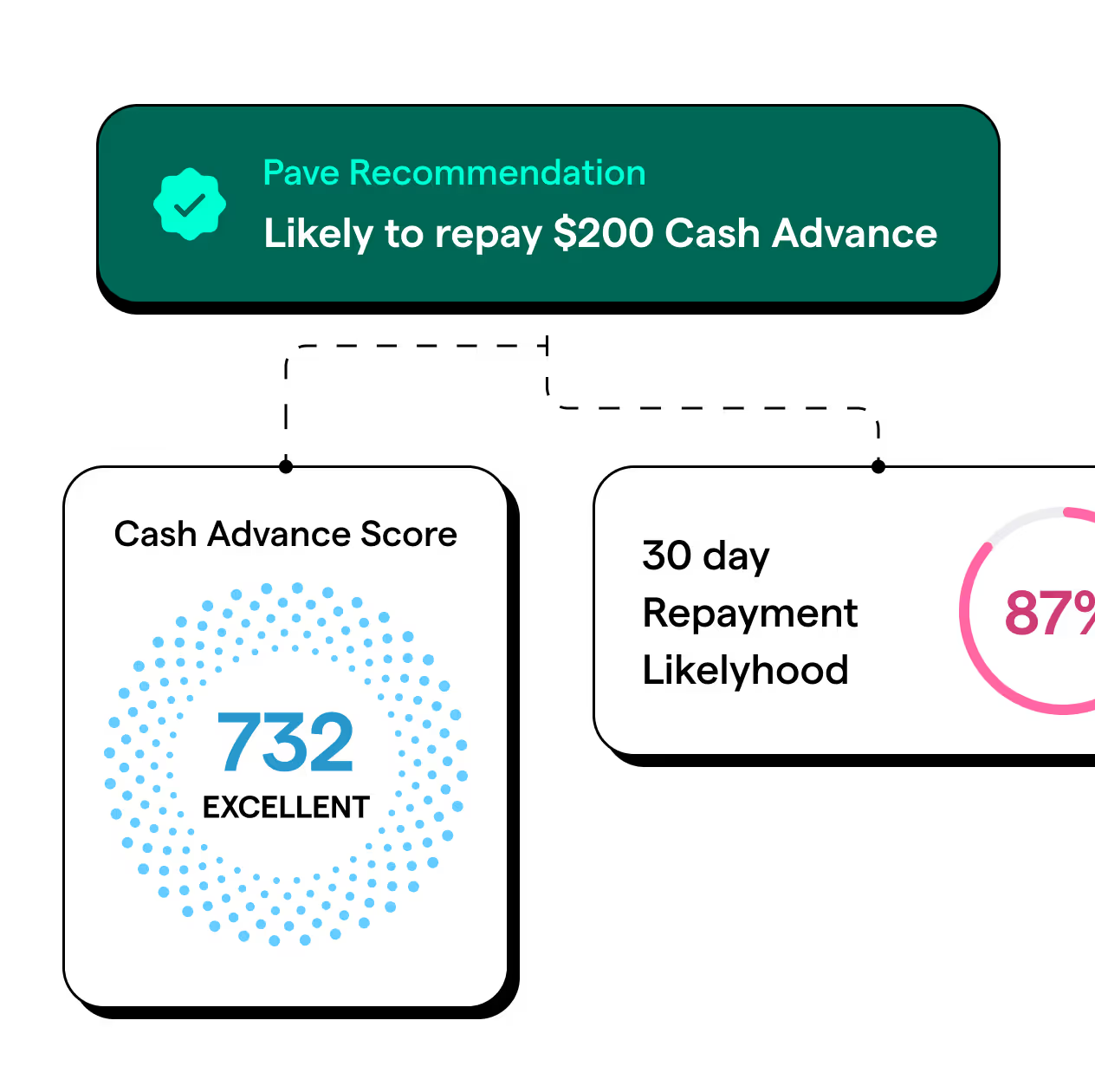

Cash Advance

Score users to increase approvals, advance amounts, and improve repayments.

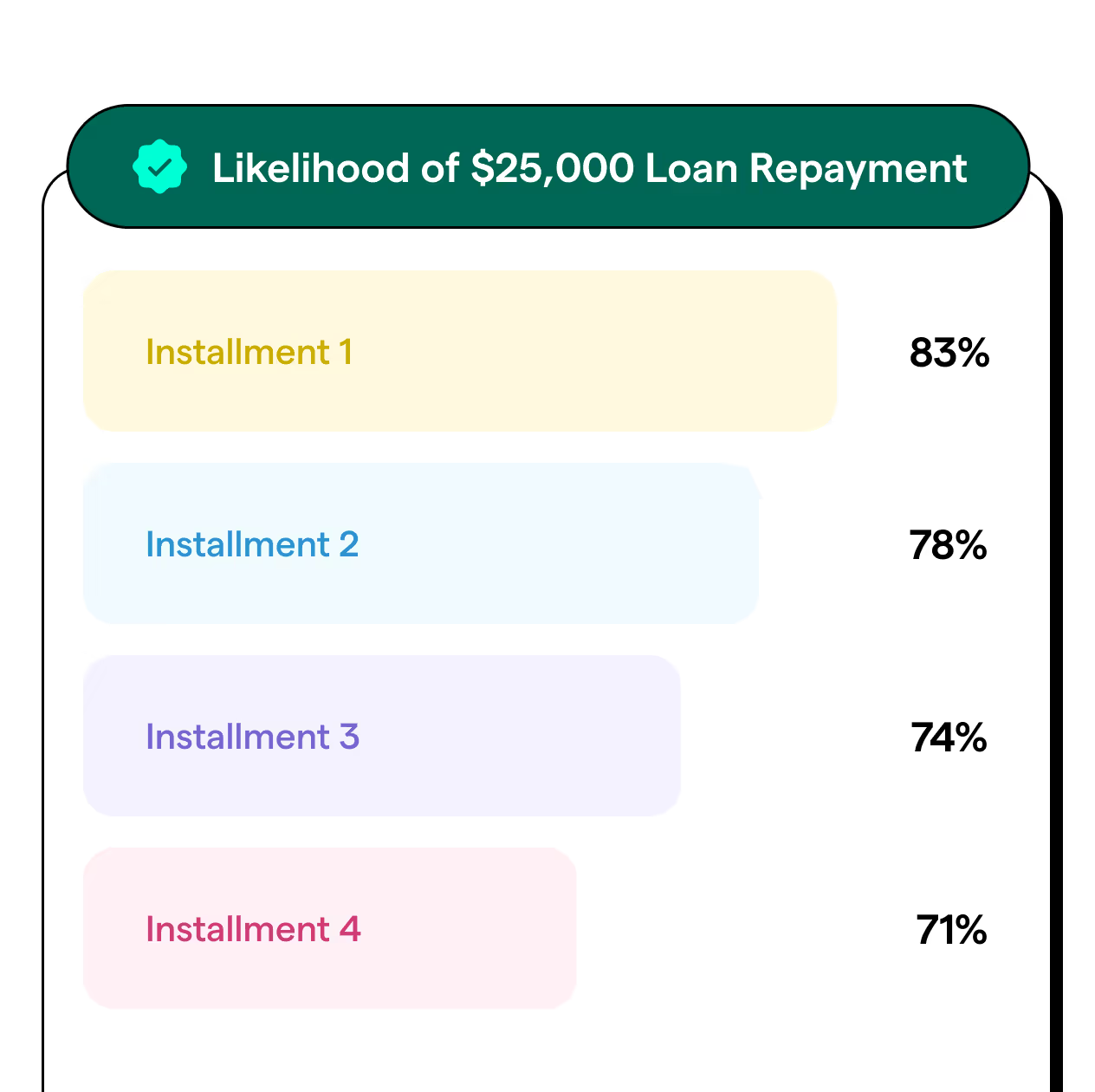

Personal Loans

Identify users with high likelihood of making the first 4 payments to reduce delinquencies.

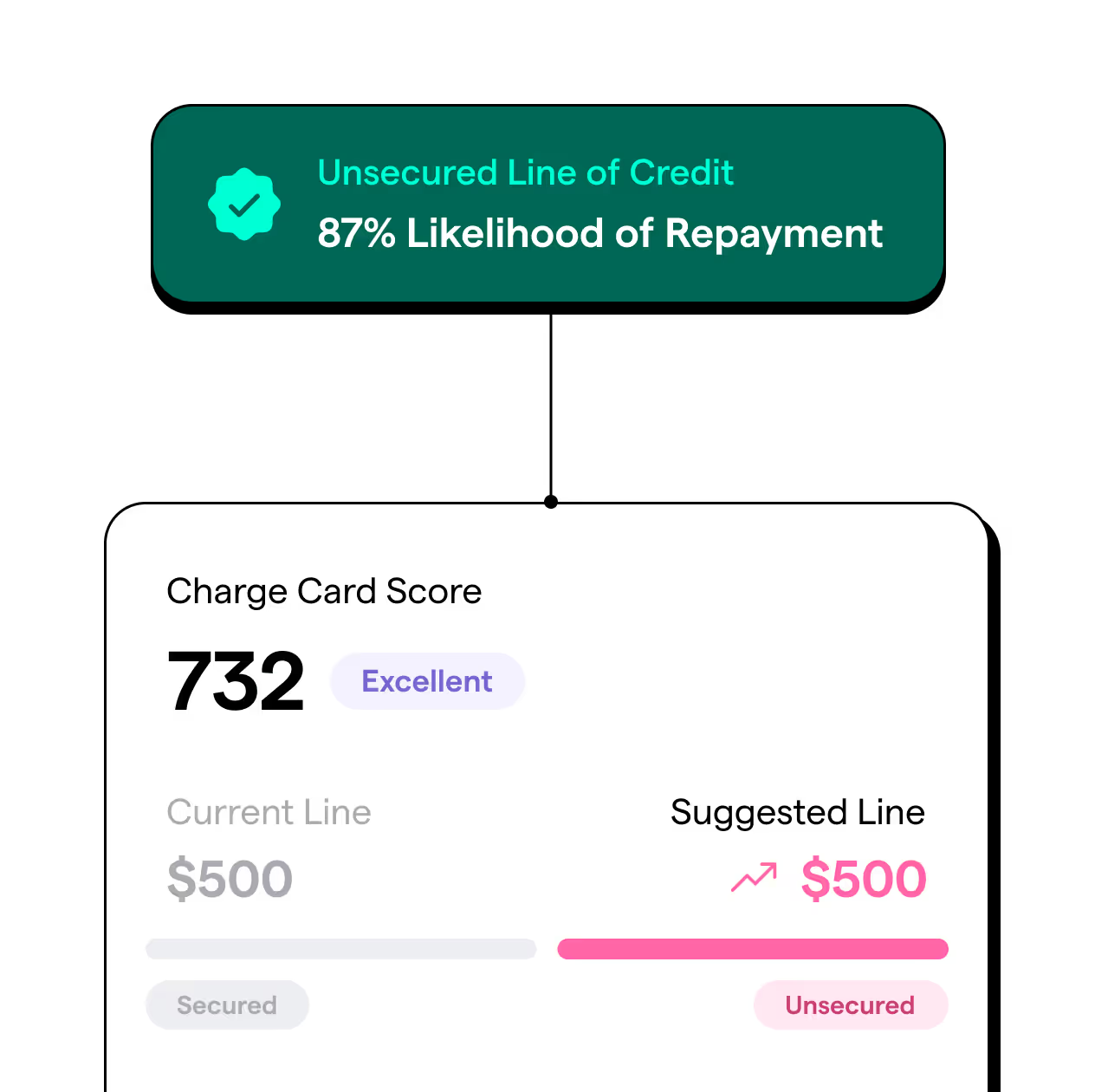

Charge Cards

Graduate users to higher secured or unsecured limits based on increased affordability.

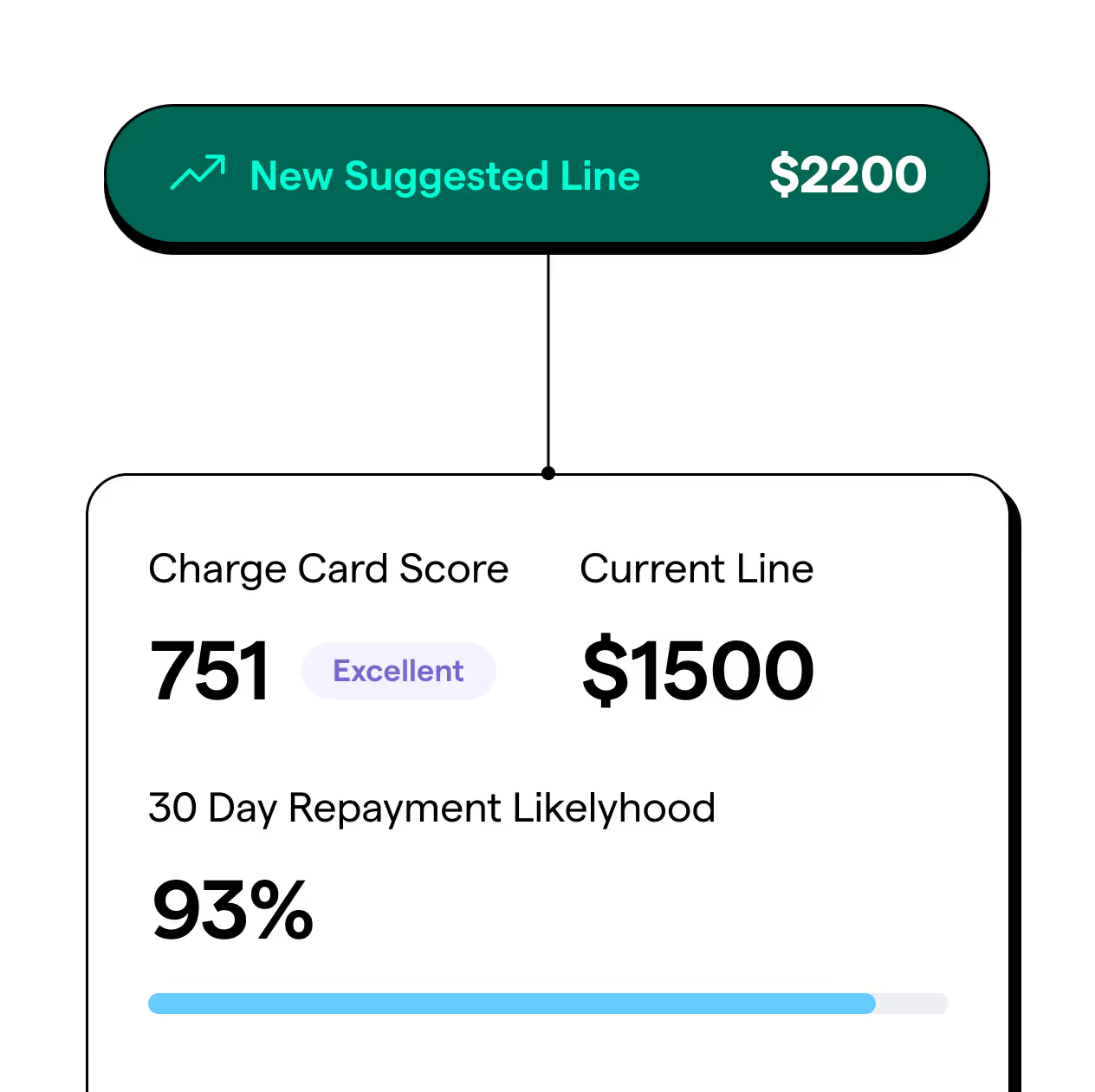

Credit Cards

Set dynamic credit limits based on users' income and affordability.

Drive growth with Cashflow-driven Analytics

Use our Cashflow-driven Attributes and Scores to provide timely, borrower-specific insights tailored to your lending criteria. Make informed decisions that enhance approval rates and loan performance.